Medigap Plan N is one of the newer Medigap plans. This plan is one of the lower levels of coverage, and consequently, also has a lower premium than other plans like Plan F and Plan G. So, could this plan be right for you?

First, let’s take a look at what is covered under Medigap Plan N:

- Medicare Part A coinsurance (the 20% Medicare does not pay)

- Medicare Part A hospital costs (additional 365 days after Medicare benefits are used)

- Medicare Part B coinsurance (the 20% Medicare does not pay) EXCEPT FOR AN UP TO $20 DOCTOR’S OFFICE CO-PAY

- Blood (first 3 pints)

- Medicare Part A hospice care coinsurance (the 20% that Medicare does not pay)

- Skilled nursing facility coinsurance (the 20% that Medicare does not cover)

- Part A deductible (currently $1288/benefit period)

- Foreign travel emergency

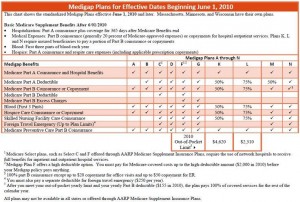

These can also be found on the Medigap coverage chart.

It’s sometimes easier to talk about what a plan does NOT cover. Plan F, which is the most comprehensive Medigap plan “checks all the boxes” and pays everything that Medicare itself does not cover. So, how does Plan N differ and what are the out-of-pocket expenses on this plan?

There are three differences in Medigap Plan N from the full coverage Plan F. Those are:

- Plan N has a co-pay structure for doctor’s visits (up to $20) and emergency room visits ($50).

- Plan N does not cover the Medicare Part B (doctor’s office) deductible, which is currently $166/year.

- Plan N does not cover the Medicare Part B Excess charges.

The first two points are pretty straight-forward, but many people have a question about Part B Excess charges. Part B Excess charges are when a doctor does not accept Medicare “assignment”. This means that they charge more than the Medicare payment schedule. He or she can choose to charge up to 15% above the Medicare payment schedule. This is prohibited in some states (PA and OH to name a couple). Also, it is relatively uncommon nationwide at this point; however, it is something to be aware of if you are considering Plan N.

Plan N is definitely a viable alternative for some people – specifically, if you are in pretty good health and don’t go to the doctor a lot, this plan can be a good fit for you. Premiums are typically $20-40/month lower than premiums for Plan F.

There are other considerations, however. For one, you do have to qualify medically to change plans after your initial open enrollment period. So, if you choose a Plan N initially, it is something you should be comfortable with long-term. If you have a pre-existing condition or develop one, you may not be able to switch to a higher plan later.

Medigap Plan N, just like all Medigap plans, is Federally-standardized. This just means that it is the same, no matter what insurance company you choose. The plans provide the same coverage, work the same way, pay claims the same way, and can be used the same places (any doctor/hospital that takes Medicare, your primary coverage).

If you have questions about Plan N or how it works, or questions about Medicare itself or the other plans, feel free to contact us on our website or call us at 877.506.3378.