Medicare Supplements, also called Medigap plans, are plans that are designed to fill in the gaps in “original” Medicare. They are optional, but they are critical to long-term financial security and stability for people on Medicare. On the surface, the plans can seem very complex and difficult to understand. However, when you take the time to understand the basic tenets of the plans, you will find they are much simpler than you think.

Understand Medigap Plans

So, what are the basic features that Medigap plans have?

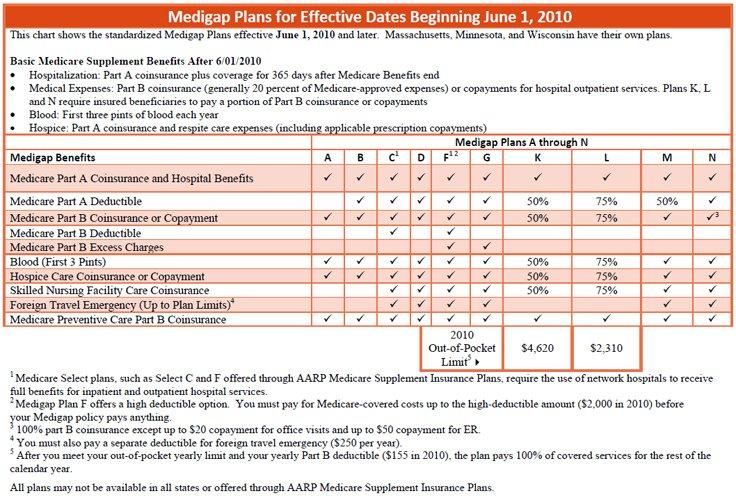

- Standardization – All companies offer the same plans. See Medigap Coverage Chart (also shown below)

- Flexibility – All plans, regardless of company, can be used at any doctor/hospital nationwide, as long as they take Medicare

- Reliability – Coverage is “guaranteed renewable” and allows you to have a fixed medical cost budget regardless of your health

There have not been any changes to the plans since 6/1/2010. The chart below shows exactly what each plan covers. Plan F is the most common plan – approximately 40% of people who have a Medigap plan have Plan F. However, Plan G and Plan N are often better values, particularly for people in good health.

CLICK TO ENLARGE CHART

Here are three other facts to keep in mind as you understand the Medigap plans:

- The companies do not all offer all of the plans. They can choose which plans they want to offer – most companies offer 2-5 plans.

- The Medicare Part B deductible, which some of the plans do not cover, is $166 for 2016.

- All companies pay claims through the Medicare “crossover” system so there is no variation in how much or how fast one company pays claims versus another.

Compare Medigap Plans

So, with that basic information in mind, how do you compare the plans?![]()

A pretty easy question, really. The two factors to look at when comparing Medigap plans are: Price and Company Rating/Reputation.

Once you know which plan you wish to go with, you can easily compare rates. It is advantageous to use an independent broker or agent to do this. Comparing this way allows you to compare all of the plans in a centralized, unbiased way so that you can make an informed choice.

If you want more information or want to discuss Medigap plans, coverage, rates, etc. – you can reach us here, email us here, or call us at 877.506.3378.