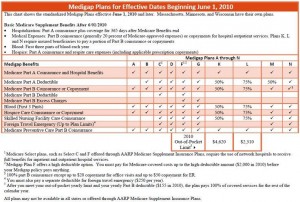

Medigap plans are standardized – each company has to offer the same coverage plans that come from the standardized plans chart. See:  Standardized plans coverage chart. All of the plans have some basic tenets and characteristics that apply to all plans from all companies. Below, we’ve listed a few of those, essential to a basic understanding of the similarities before endeavoring to understand the differences:

Standardized plans coverage chart. All of the plans have some basic tenets and characteristics that apply to all plans from all companies. Below, we’ve listed a few of those, essential to a basic understanding of the similarities before endeavoring to understand the differences:

- First and foremost, all of the plans can be used at anywhere that takes Medicare nationwide. Medigap plans are non-network plans.

- All plans work with Medicare – they do not replace Medicare (i.e. Medicare Advantage). And, claims are all paid, regardless of the plan or company, through the Medicare “Crossover” system (automated).

- There are four total benefits that all Medigap plans contain some form of coverage for (most plans account for full coverage of all of these benefits – see chart for full details). Those four benefits are: Medicare Part A coinsurance hospital benefits, Hospice care coinsurance, Blood, and Preventive Care coinsurance

So, now that we understand what all of the Medigap plans have in common – how are they different?

First of all, let’s divide the plans into three groups:

The Common Plans

It makes sense to start with the top level of coverage, Plan F. Up until 2010, there was a plan called Plan J, which was the top level of Medigap coverage. In 2010, Medicare enveloped some of the benefits that differentiated ‘J’ and ‘F’. So, ‘J’ was eliminated and ‘F’ stood pat as the most comprehensive plan. Some ‘J’ policyholders still exist but the plan can no longer be sold to new applicants. Plan F pays everything that Medicare A & B do not cover so that you have no out of pocket costs at the doctor/hospital – no co-pays, deductibles or coinsurance.

One level down from that is Plan G. Plan G is the same as ‘F’ in every way except that it does not cover the Part B deductible. For 2012, that deductible is $140/year. Plan N is considered the next most commonly held plan and is a lower-cost alternative to ‘F’ and ‘G’. Plan N does not cover the Medicare Part B deductible (just like ‘G’). Also, it has a co-pay structure – $20 at the doctor’s office and $50 at the ER. Additionally, it does not cover the Medicare Part B excess charges.

The Similar Plans

By similar, I mean that these plans are similar to the plans that are mentioned above. In this category, I would put Plans C, D, and M. These plans are not offered by nearly as many companies as the three plans listed above, and thus, are not nearly as popular. Plan C is very similar to Plan F – the only difference is that it doesn’t cover the Part B Excess charges. Plan D is very similar to Plan G for the same reason – it does not cover the Part B excess charges (in addition to not cover the Medicare Part B deductible). Lastly, Plan M is similar to Plan N. It is a tradeoff – on ‘N’, you have the co-pay structure mentioned above, but on ‘M’, you don’t have the co-pays. In their place, you have coverage of only 50% of the Medicare Part A (hospital) deductible.

The Leftover Plans

Of the 10 total plans, that leaves 4 other plans that have not been discussed. The plans have, between the four of them, less than 10% market share, so they are not very commonly offered and not very often used. These plans are: A, B, K and L. These benefits on these plans speak for themselves on the Medigap coverage chart. And, even if you decide one of these plans is for you, you are relatively hard pressed to find any companies that offer it or any competitive pricing.

Do you have questions about what the plans cover? Or, questions about how they work? Medigap-Quote.com is a leading, independent brokerage that can help you compare all of the plans for your age and zip code in an unbiased way, without having to meet with anyone or talk to an agent. If you have questions or do wish to speak with someone, please call us at 877.506.3378. Or, you can visit us online at: Medigap-Quote.com.