As we approach the end of 2013, a question that we are getting frequently is what is  about Medigap changes for 2014. The simple answer to what is changing is “Nothing”. Despite the persistent dissemination of information about “Obamacare”, the changes that are going on in the “under 65” market do not apply to those on Medigap plans.

about Medigap changes for 2014. The simple answer to what is changing is “Nothing”. Despite the persistent dissemination of information about “Obamacare”, the changes that are going on in the “under 65” market do not apply to those on Medigap plans.

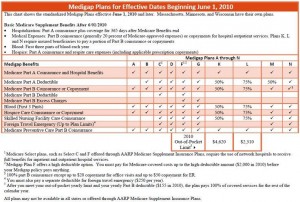

Medigap plans do change from time to time. The last time that the coverage chart changed was June 1, 2010. See the current Medigap coverage chart. However, these changes do not occur on a year-to-year basis and the coverage on Medigap plans does not change with the calendar year, like it does with Medicare Advantage and Part D plans.

All that said, the rates for Medigap plans in 2014 likely will change with most companies, just as they have in past years. This occurs for a handful of reasons, including but not limited to changes to Medicare co-pays and deductibles, your individual increased age, and claims experiences for your particular Medigap company. These rate changes can happen at any time, though. They do not only happen at the end of the year or during the annual enrollment period.

Any time that your company changes your Medigap rate they must notify you at least 30 days in advance of the change. This is typically done by mail. If/when you receive a change in your Medigap rate, whether it is mid-year or at the end of the year, it is advisable to compare rates on the plan that you have. This can be accomplished very easily and will ensure that you are not paying too much for your coverage.

Due to the standardization of Medigap plans, you can always compare “apples to apples”. For example, if you have a Plan F, you can easily compare other Plan F rates. Or, even more advantageous, you could compare Plan G rates (Plan G is, in almost all cases, a better “deal”). This would give you an idea of how your current plan stacks up against what else is available.

All in all, Medigap plans will go up over time. However, they are not necessarily going up 1/1/14. The upcoming end-of-year enrollment period has nothing to do with Medigap plans – you can change at any time. But, if your rate does go up, now or in the future, it is a good idea to re-evaluate and make sure you have the best deal on your chosen plan.

Medigap-Quote.com is an independent broker of Medigap plans. We work with 35+ companies in 39 states and can help you compare all plans in a centralized place by email. If you have questions or wish to discuss in more detail, request Medigap quotes or call 877.506.3378.