*This is Part 1 in a 3-part series designed for people going on Medicare or turning 65. Please contact us if you have any questions about this information or fill out a quotes request if you want to get Medigap quotes.*

Understanding Medicare and basic Medicare terminology is crucial to someone who is coming up on a Medicare start date. If you are on Medicare, or going on Medicare, your health care should be very important to you. Because you are on Medicare through either disability or turning 65, it is important to understand how Medicare works, what it covers, and most importantly, to know what you have and don’t have when you have Medicare.

Medicare, if you don’t already know, is the Federal health insurance program for people over age 65 or disabled. There are several parts of Medicare. First of all, Part A covers hospital/inpatient charges. Everyone gets this when they become eligible for Medicare, as long as he or she has worked 10 years and paid into the Medicare system through payroll taxes for this length of time. There is no premium for Part A in almost all cases.

Part B is optional. If you are still working past age 65, you can decline to take it at age 65. It covers doctor visits, outpatient services, labwork etc. There is a premium associated with Part B. It is dependent, to an extent, on income and varies based on when you started with Medicare. But for most people the current Part B premium is $134/month (2017). This typically is paid as a deduction from your Social Security check. If you are turning 65 and already receiving Social Security, you will be automatically enrolled in Medicare Parts A & B. You’ll receive a card 2-3 months before your Medicare start date, which is the 1st day of the month you turn 65, stating that you will have Medicare Parts A & B. You would have to then notify Medicare if you did not want Part B to start then.

Part C is also an optional part of Medicare. It is also called Medicare Advantage. Medicare Advantage plans are private insurance plans, which replace (or take the place of) Medicare Parts A & B. There are sometimes premiums associated with these plans, and coverage is provided through the private insurance company instead of through Medicare itself. In recent years, there have been many changes to these plans, including reductions in coverage and doctor acceptance. As a result, we do not necessarily recommend them as an advantageous option in most situations. But this is largely dependent on where you live, your income/assets, and your individual health situation.

Part D is the part of Medicare that covers prescription drugs. This is also optional, although there is no prescription coverage in Parts A & B. Also there is a penalty to delay enrollment into Part D unless you have other credible coverage. So, most people enroll in Part D when they are first eligible.

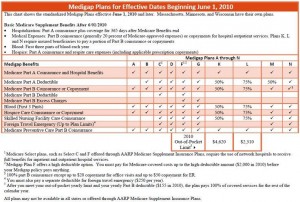

Medigap plans (also called Medicare Supplements) are plans that fill in the gaps in Medicare Parts A & B. These plans are sold by private insurance companies and standardized by the Federal government. Premiums can vary widely on these plans – by state, age, gender, etc. When you go on Medicare, it is crucial to compare Medigap premiums to ensure that you get a good deal on the plan you choose since the premiums vary from company to company for the exact same coverage.

Tomorrow, we will look at more specifics about when you should sign up for the various parts of Medicare, how to do so, and what your other options are.

Medigap-Quote.com is one of the nation’s leading independent brokers of Medigap plans. We work with 30+ companies in 40+ states and work exclusively with this type of insurance. As a result, we can provide unbiased, experienced expertise to those going on Medicare and turning 65. Feel free to contact us or request Medigap quotes online.