*This is Part 3 in a 3-part series designed for people going on Medicare or turning 65. Please

contact us if you have any questions about this information or fill out a quotes request if you want to get Medigap quotes.*

contact us if you have any questions about this information or fill out a quotes request if you want to get Medigap quotes.*

Medigap plans, Medicare Advantage and Part D are additional coverages that you should be considering if you are going on Medicare. Each of these has their own unique designs and advantages/disadvantages. This article is intended to introduce you to each and give you more information to consider about what is right for you.

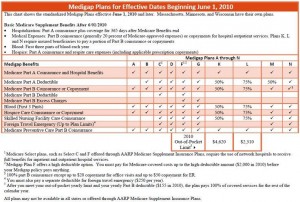

First of all, let’s take a look at Medigap plans. Medigap plans are sold through private insurance companies, but they are Federally-standardized. What this means is that each company has to offer one of the standardized plan designs. The chart that shows these standardized plans can be seen here. As you can see, Plan F is the most comprehensive plan – it pays what Medicare Parts A & B do not cover at the doctor and hospital, so you should not have any out of pocket expenses. It is, of course, the most expensive. Other common lower-premium, less-coverage options include Plan G and Plan N. Plan G, in particular, is often a better value than Plan F (Read more about Why Plan G is often better than Plan F).

In addition to the coverage being standardized with Medigap plans, the claim payments and doctor acceptance are also standardized. That is, if a doctor/hospital takes Medicare, he or she will take the standardized Medigap plan that you have, regardless of which company sells you the plan. Additionally, claim payments are processed through the Medicare “crossover” system, so the plans, essentially, “follow” Medicare as a supplement and claims are all handled electronically. For these reasons, it is important to compare the Medigap plans on the basis primarily of cost and company rating. These are the two variables that can differ from one company to the next. You can get a Medigap quotes comparison for you area sent to you by email.

Medicare Advantage is entirely different from Medigap. Many people mistakenly lump them in together or call Medicare Advantage plans “Medicare Supplements”. This is not accurate, as Medicare Advantage plans do not supplement Medicare, but rather take its place in paying claims. These plans have networks, and most are either PPOs or HMOs. Often, premiums are lower than the premiums of Medigap plans, but the coverage is typically also lower. They, in most cases, work more like traditional employer/group type plans. There are some distinct drawbacks to this type of plan, in our experience, and we do not recommend them in most instances. Some of the particular downsides are the network restrictions (which are often based on your county or state) and future plan change issues. If you take a Medicare Advantage plan when first eligible for Medicare, you do have to qualify medically to switch to a Medigap plan at a later time.

Medicare Part D is a part of Medicare, but it is sold through private insurance companies. Part D covers prescription drugs. There are typically 20-40 plans in each county, so it is crucial to compare the plans based on how well they cover your current medications. Co-pays and plan premiums can vary greatly. You can do this on Medicare’s website at: Compare Part D plans.

It is important to sign up for Part D when first eligible unless you have creditable coverage. Medicare imposes a 1% per month penalty if you do not sign up for a Part D plan when you are first eligible (you are exempt from this penalty if you have creditable coverage through an employer-type plan). Premiums for Part D typically range from $15/month to $100/month so it is vital to choose a plan that covers your medications and is the appropriate coverage level for your current medication usage. You can change Part D plans during the annual enrollment period which runs October 15-December 7 each year.

This article explains some of the other coverages that go with Medicare, such as Medigap, Medicare Advantage and Part D. If you still have questions or want to discuss further, please feel free to contact us.

Medigap-Quote.com is one of the nation’s leading independent brokers of Medigap plans. We work with 30+ companies in 40+ states and work exclusively with this type of insurance. As a result, we can provide unbiased, experienced expertise to those going on Medicare and turning 65. Feel free to contact us or request Medigap quotes online.